18+ Cpa Letter Mortgage Loan

The AICPA has developed a matrix which outlines common. Web Result Apply now.

Templatelab

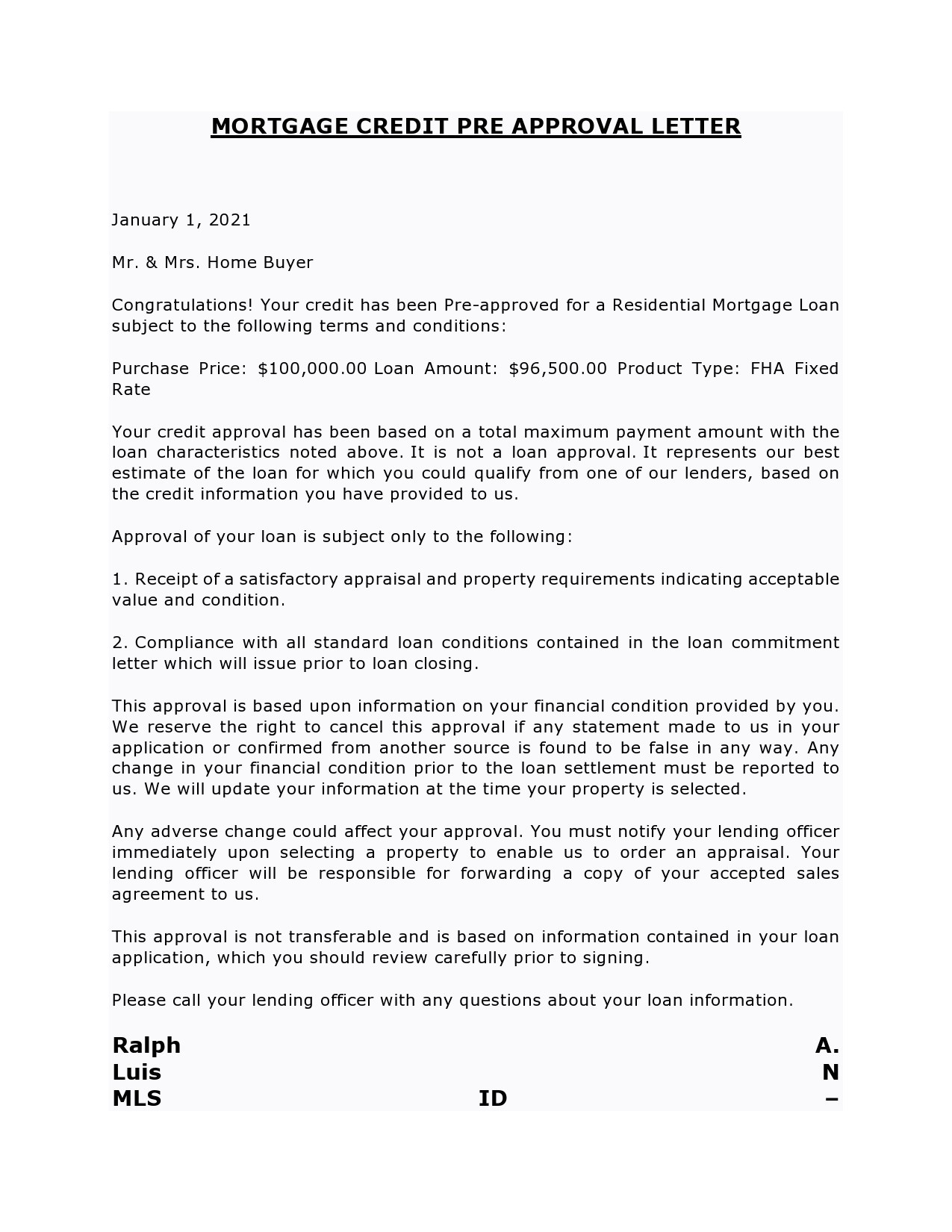

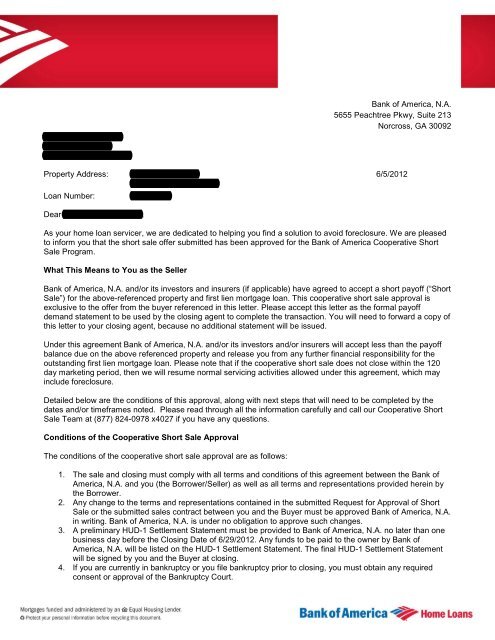

Web Result The letter is issued by the loan applicants CPA or Tax Preparer who affirms that heshe prepared the applicants tax returns and that the applicant is.

. Showing 1 - 60 of 404 Results. Web Result What Is a Letter of Explanation. Search Forms by StateView Pricing DetailsChat Support AvailableCustomizable Forms.

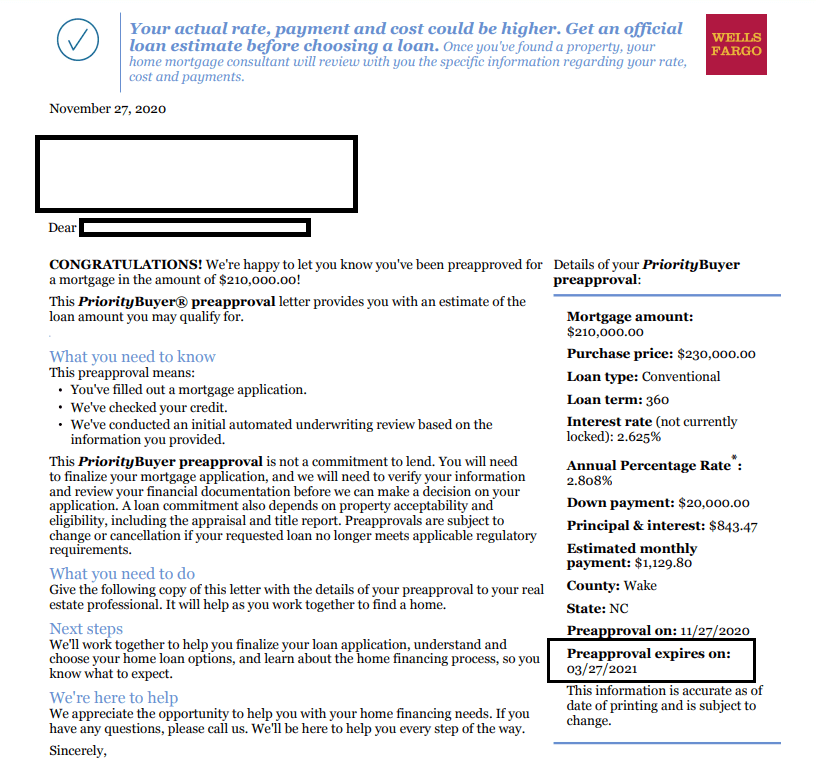

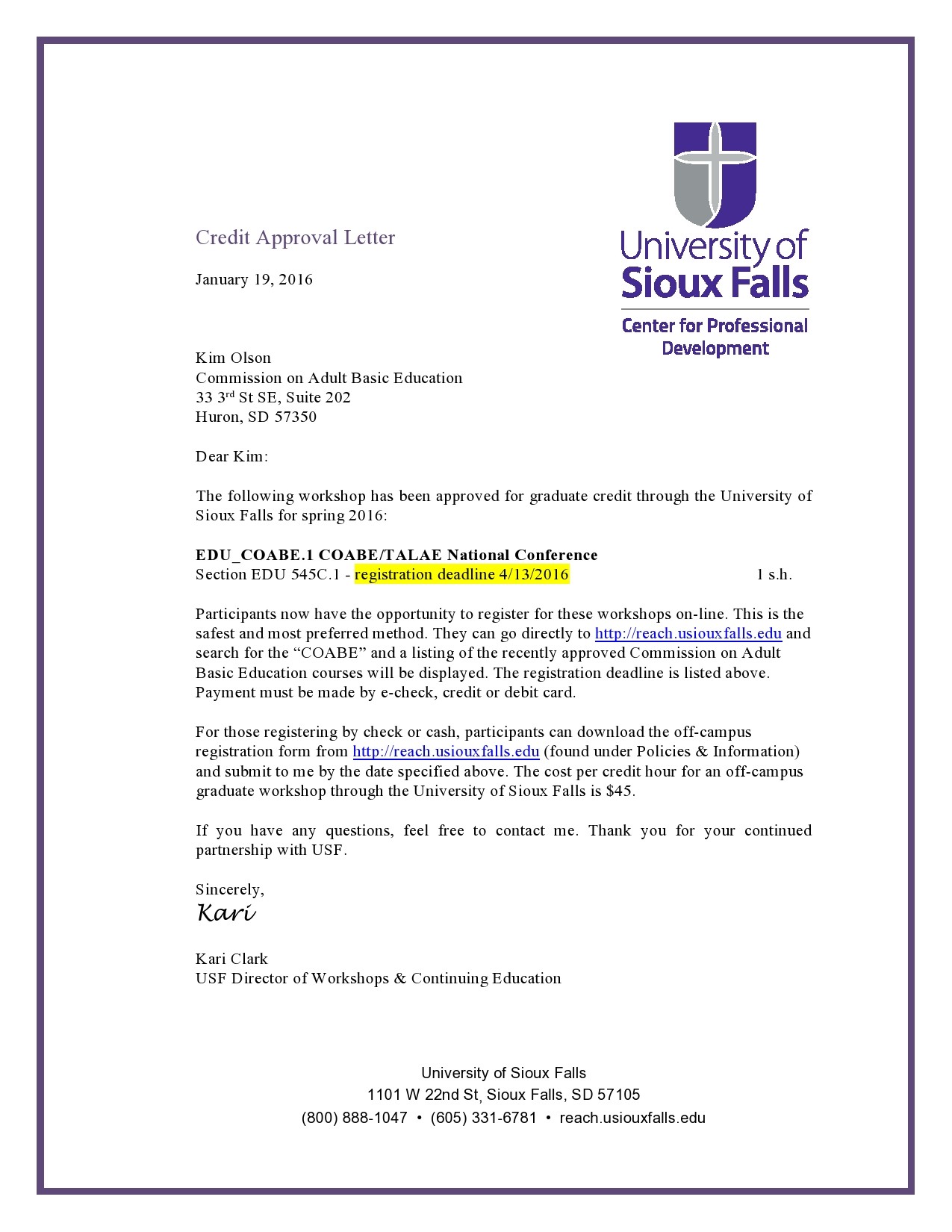

You will owe your lender a stack of documents once you apply and during underwriting that show you can repay the loan. This topic contains information on general income and employment documentation requirements for DU including. Available on primary residence 2nd home and investment property.

Web Result Nowadays landlords lenders and mortgage brokers ask self-employed individuals for a letter from a CPA to verify their self-employment -. Web Result You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Eligible Mortgages Pools and Loan Packages.

A letter of explanation is your chance to answer any questions a lender might have about your loan application. Acceptable forms of verification can include emails or letters from. Web Result Option 1 Unaudited profit-and-loss statement from a CPA or Enrolled Agent EA.

No tax returns required. Cash Deposit on Sales Contract Earnest Money Gifts and Grants. General Income Documentation Requirements.

And why accomplish your make CPA firms uncomfortable. This topic contains information about certain asset policies in DU including. 600 credit score minimum.

Web Result Financial Reporting Center FRC Technical 3rd Party Verification Comfort Letter Requests. Web Result Construction-to-Permanent C-to-P financing allows lenders to replace the interim construction financing borrowers use to construct a new residence with a long-term mortgage that can be delivered to Fannie Mae. Weve compiled some of our most common questions on the offering below.

Web Result Introduction. A mortgage application typically requires. Alternative Documentation Requirements for Income.

All Fannie Mae Single-Family Sellers Impact of COVID-19 on Originations. The policy for sale of loans. Assembling and Submitting Pool and Loan Package Issuance Documents.

Web Result Rebecca Lake March 5 2020. Great option for self-employed borrowers. Web Result So what are comfort letters.

However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017. Web Result Application for Commitment Authority Pool and Loan Package Numbers. Web Result Lender Letter LL-2021-03.

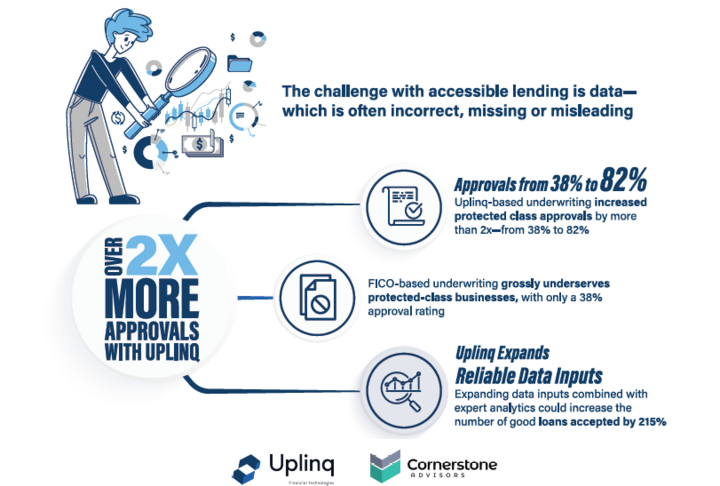

Web Result A comfort letter is sometimes requested by a bank mortgage company insurance company or vendor when considering a loan mortgage or in general. Web Result Employment verification will confirm your self-employment. Web Result There has been an increasing trend of banks or lenders asking self-employed individuals for letters from a CPA to verify certify vouch for or.

Please note that obsolete letters are not included. Web Result Factors to Consider for a Self-Employed Borrower. Web Result B3-44-02 Requirements for Certain Assets in DU 06012022 Introduction.

Any individual who has a 25 or greater ownership interest in a business is considered to be self. Reduced Income Documentation Requirements for High LTV Refinance Loans. Verus will allow an unaudited PL prepared by a CPA.

Web Result You can search these regulatory letters going back to 1979 by document type the year issued by subject and by title or keywords. Web Result Bank Statement Loans Highlights. As low as 10 down payment.

Lets explore the risks of mortgage comfort letters to CPA.

Nelson Cpa

Template Net

Supermoney

1

Qwikresume Com

Yumpu

1

Template Net

Jvm Lending

Youtube

Us Legal Forms

Calameo

Pinterest

Dochub

Addressers

Upwork

Templatelab